The bank’s mortgage portfolio grew slightly to $270.9 billion from $270.5 billion in Q4 2024, while its home equity line of credit (HELOC) portfolio reached $124.2 billion, up from $123 billion in the previous quarter.

Despite the modest figures, TD remains optimistic about future growth, pointing to strategic changes that are expected to drive stronger performance in the coming quarters.

“This is a business that we like, that we want to grow, and we’re continuing to compete to win profitable business,” Sona Mehta, TD’s head of Canadian Personal Banking, said on the earnings call.

Mehta highlighted that TD is a “through-the-cycle multi-channel lender,” which gives the bank “great reach” within the market. “Especially over the last couple of quarters, we’ve been leaning in to enhance how we go to market, especially in our proprietary channels,” she added.

As part of the bank’s ongoing efforts to strengthen its position, TD introduced new roles, including resolute specialists and investing specialists, in its highest opportunity branches.

“We’ve thoughtfully enhanced that integration between our branch and our mortgage sales force at the same time. We’re seeing really promising results,” Mehta said.

Referrals from branches to mortgage sales teams have tripled quarter-over-quarter, translating into $1 billion in funded volumes, marking the best Q1 on record for TD’s Mobile Mortgage Specialist (MMS) team.

“Now, overall growth will vary from quarter-to-quarter, but the fundamentals are absolutely pointed in the right direction,” she noted. “I think you typically see some seasonality that’s lower in Q1 but ultimately, this is a good book. We compete to win profitable business [and] we’re seeing really good results in our proprietary channels.”

TD’s upcoming mortgage renewals

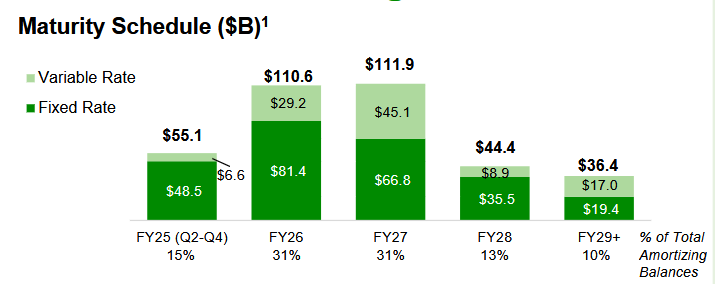

Like Canada’s other big banks, TD’s mortgage portfolio is set to face a wave of renewals in the coming years, with $110.6 billion in FY26 and $111.9 billion in FY27.

By 2027, about three quarters of TD’s total amortizing mortgage portfolio will be up for renewal. Many of these borrowers, who locked in 5-year fixed rates at rock-bottom levels during the pandemic, will face payment increases as they renew in a higher-rate environment.

TD’s average amortization lengths normalizing

TD also reported an ongoing normalization in the average remaining amortization periods across its mortgage portfolio.

As one of Canada’s major banks offering fixed-payment variable-rate mortgages, like RBC and BMO, which keep monthly payments steady despite interest rate changes, TD has seen its mortgage amortization periods continue to decline in the wake of Bank of Canada rate cuts.

As of the latest quarter, just 8.7% of its portfolio had an amortization period of 35 years or more, a notable decrease from the 27.4% peak in Q1 2023.

Remaining amortizations for TD residential mortgages

| Q1 2024 | Q4 2024 | Q1 2025 | |

|---|---|---|---|

| 15-20 years | 14.1% | 16.8% | 18.9% |

| 20-25 years | 31.5% | 33.3% | 32.9% |

| 25-30 years | 24.6% | 28.9% | 29.4% |

| 30-35 years | 1.4% | 2.4% | 1.2% |

| 35 years and more | 19.2% | 8.7% | 6.9% |

TD earnings highlights

Q1 net income (adjusted): $3.2 billion (+8% Y/Y)

Earnings per share: $1.97

| Q1 2024 | Q4 2024 | Q1 2025 | |

|---|---|---|---|

| Residential mortgage portfolio | $261.3B | $270.5B | $270.9B |

| HELOC portfolio | $117.6B | $123B | $124.2B |

| Percentage of mortgage portfolio uninsured | 83% | 83% | 84% |

| Avg. loan-to-value (LTV) of uninsured book | 50% | 52% | 53% |

| Portfolio mix: percentage with variable rates | 37% | 34% | 36% |

| % of mortgages renewing in next 12 months | 13% | 59% | 59% |

| Canadian banking gross impaired loans | 0.14% | 0.18% | 0.19% |

| Canadian banking net interest margin (NIM) | 2.78% | 2.80% | 2.81% |

| Total provisions for credit losses | $878M | $1.109B | $1.109B |

| CET1 ratio | 15.2% | 13.1% | 13.1% |

Note: Transcripts are provided as-is from the companies and/or third-party sources, and their accuracy cannot be 100% assured.

big bank earnings Editor's pick Lender Calls quarterly earnings Sona Mehta td TD amortizations td bank TD bank amortizations TD bank earnings TD bank quarterly earnings TD Bank renewals

Last modified: May 25, 2025

TD is the Donald Trump of the mortgage world. They should rebrand their logo to be orange