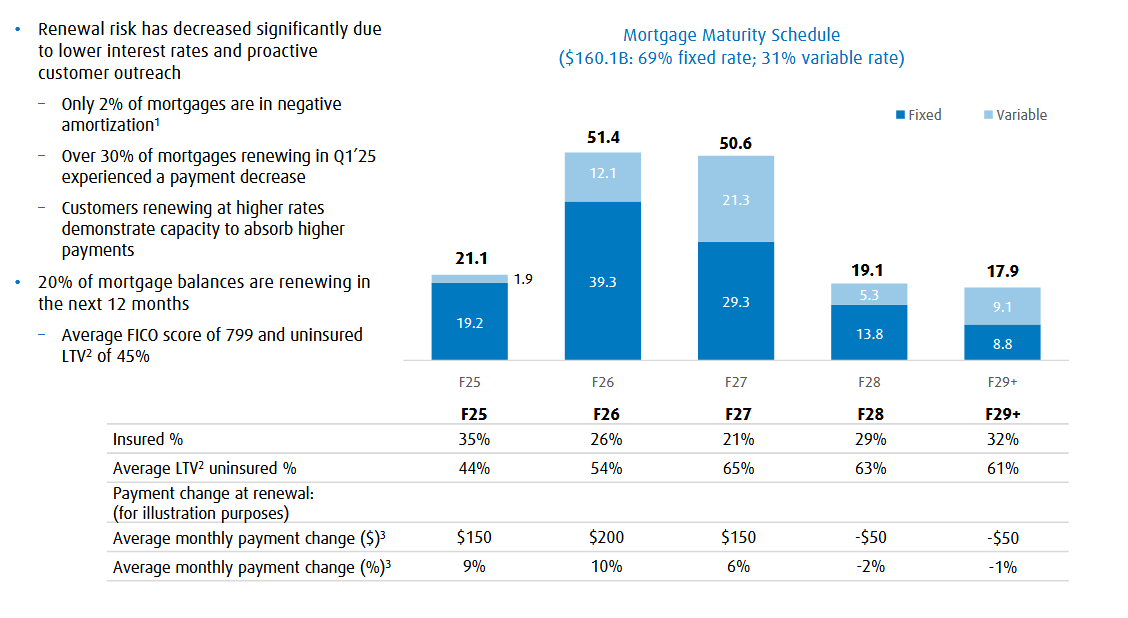

In its latest earnings report, BMO revealed a growing number of mortgage holders are seeing their monthly payments go down. More than 30% of customers renewing in Q1 2025 ended up with lower monthly payments.

However, the majority of borrowers still faced higher payments at renewal—regardless of whether they had fixed- or variable-rate mortgages. On average, monthly payments increased by $150 to $200, a rise of 6% to 10% for most borrowers.

While payment pressures remain, BMO’s data suggests some relief is on the horizon. Looking ahead to 2028 and 2029, the bank expects average mortgage payments to decrease by roughly $50 per month, a sign that future renewals may be easier for borrowers if rates continue to decline.

Negative amortization mortgages continue to shrink

Meanwhile, the number of variable-rate mortgages in negative amortization—where payments don’t fully cover the interest owed—has now dropped to just 2%, or $2.9 billion, of BMO’s mortgage book.

That’s a dramatic improvement from the peak of the rate-hike cycle, when 62% of BMO’s variable-rate borrowers were in negative amortization.

- What is negative amortization? Negative amortization impacts borrowers with fixed-payment variable-rate mortgages in an environment when prime rate rises significantly, resulting in the borrower’s monthly payment not covering the full interest amount. This causes the mortgage to grow rather than shrink.

The bank’s latest earnings show a sharp drop in ultra-long amortizations, thanks to rate cuts and moderating payment increases for renewing borrowers.

Like other banks that offer fixed-payment variable-rate mortgages, such as TD, CIBC, and RBC, BMO is seeing average amortization periods fall.

The percentage of mortgages with amortizations of 36+ years dropped sharply, from 24.9% in Q4 2023 to just 7.7% in Q1 2025. Over 64% of the bank’s mortgage portfolio now has an amortization under 25 years.

This decline is attributed to a combination of borrowers making prepayments, mortgages resetting to their original contracted amortization at renewal, and the ongoing easing of variable-rate mortgages following Bank of Canada rate cuts.

Remaining amortizations for BMO residential mortgages

| Q1 2024 | Q4 2024 | Q1 2025 | |

|---|---|---|---|

| 16-20 years | 13.4% | 16.1% | 18.1% |

| 21-25 years | 31.7% | 33.8% | 35.7% |

| 26-30 years | 13.1% | 26.5% | 25.5% |

| 31-35 years | 1.9% | 3.6% | 2.4% |

| 36+ years | 22.8% | 10.1% | 7.7% |

Mortgage delinquencies jump higher

BMO noted that renewal risk has decreased thanks to lower interest rates and customer adjustments, though the bank still saw a material rise in the percentage of mortgage holders who are falling behind on their payments.

The 90-day delinquency rate for BMO’s mortgage portfolio has risen from 0.17% in Q1 2024 to 0.29% in Q1 2025.

Beyond mortgages, the bank is also keeping a close watch on its unsecured lending portfolio, where it expects more challenges ahead.

“With persistently high consumer insolvencies and unemployment continuing to inch up in Canada, we expect weakness in unsecured credit to continue through 2025,” said Chief Financial Officer Tayfun Tuzun.

Trade war uncertainty causing some borrowers to move to the sidelines

Beyond rising delinquencies, BMO is also keeping a close watch on the potential fallout from escalating trade tensions. Uncertainty surrounding U.S. tariffs is already affecting business confidence, with some borrowers delaying major purchases and investment decisions.

“Trade wars introduce uncertainty and disrupt the efficient allocation of capital,” said Tuzun. “Capital seeks clarity, as you all know, and there’s some uncertainty overshadowing that. To that end, we are seeing some clients on both sides of the border adopt a more cautious posture around capital deployment.”

Chief Risk Officer Piyush Agrawal added that the full impact of new tariffs is difficult to predict.

“There are so many unknowns in this tariff scenario,” he said. “We don’t know the duration. We don’t know what percentages will be. We don’t know which industries might get excluded. We don’t know what monetary and fiscal policy actions the government might take here to mitigate some of the impact.”

Looking at the bank’s individual borrowers, he added that, “not everybody gets impacted the same way.”

Under its current forecasts, the bank has lowered its total provisions for credit losses to a little over $1 billion, down from more than $1.5 billion in Q4.

“Provisions for credit losses declined from the prior quarter as expected, and we continue to review and pressure test our portfolio in light of geopolitical uncertainty,” said President and CEO Darryl White.

BMO earnings highlights

Q1 net income (adjusted): $2.3 billion (+21% Y/Y)

Earnings per share (adjusted): $3.04 (+19%)

| Q1 2024 | Q4 2024 | Q1 2025 | |

|---|---|---|---|

| Residential mortgage portfolio | $150B | $158.9B | $160.1B |

| HELOC portfolio | $48.7B | $49.9B | $49.9B |

| Percentage of mortgage portfolio uninsured | 71% | 73% | 73% |

| Avg. loan-to-value (LTV) of uninsured book | 56% | 52% | 53% |

| Mortgages renewing in the next 12 months | $17.6B | $27.1B | $32B |

| % of portfolio with an effective amz of <25 yrs | 56% | 60% | 64% |

| 90-day delinquency rate (mortgage portfolio) | 0.17% | 0.25% | 0.29% |

| Canadian banking net interest margin (NIM) | 2.77% | 2.74% | 2.79% |

| Total provisions for credit losses | $627M | $1.5B | $1.01B |

| CET1 Ratio | 12.8% | 13.6% | 13.6% |

Conference Call

On BMO’s ongoing share buyback:

- “BMO began executing our share buyback program as planned after receiving regulatory approval, repurchasing 1.2 million shares this quarter and a total of 3.2 million shares as of today,” White said.

On bank deposits:

- “Deposits were up 5% and loans were up 2%, excluding the impact of the RV loan portfolio sale in the prior year, reflecting growth in consumer loans, offset by still muted commercial lending demand,” said Tuzun.

Source: Q1 Conference Call

Note: Transcripts are provided as-is from the companies and/or third-party sources, and their accuracy cannot be 100% assured.

bank earnings bmo BMO amortizations BMO earnings BMO earnings results Darryl White earnings earnings calls Lender Calls Piyush Agrawal Tayfun Tuzun

Last modified: February 27, 2025