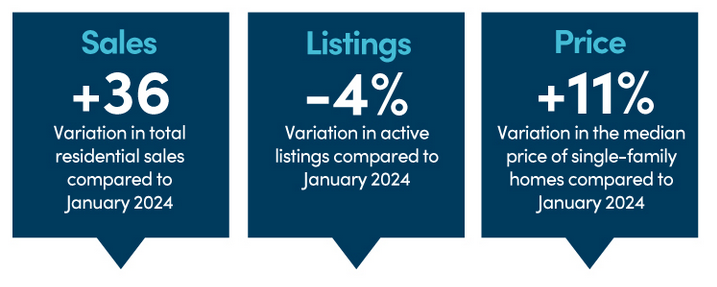

A total of 2,812 homes changed hands, marking a significant rebound from previous months and even surpassing the usual activity for January, according to statistics from Quebec Professional Association of Real Estate Brokers (QPAREB).

Single-family homes saw the biggest boost, particularly on the Island of Montreal, where sales surged by 55%.

This uptick is largely attributed to the recent interest rate cuts and new homeownership measures aimed at helping homebuyers, which have made it easier for many to qualify for financing.

“Many households (nearly 20% of the latent demand since June 2024) have since been able to qualify,” noted Charles Brant, Director of Market Analysis at QPAREB. “They have, in part, taken action after waiting for many quarters and despite an economic outlook that rapidly became tinged with uncertainty in January.”

Despite the positive sales numbers, supply remains a challenge, with the number of active listings down by 4%. This continues to put pressure on prices, especially for single-family homes, which saw an 11% price increase.

In January, the median price for single-family homes rose to $590,700, while condominiums saw median prices rise 8% year-over-year to $420,000.

While confidence in the market is slightly down, especially regarding big-ticket purchases like homes, much of the outlook still depends on how trade tensions with the U.S. unfold, which could affect interest rates and, in turn, the market’s future direction.

“For the time being, this remains the most important element of predictability for both buyers and sellers,” Brant noted.

Montreal montreal home sales montreal house prices montreal housing market QPAREB Quebec Quebec Professional Association of Real Estate Brokers Regional

Last modified: February 7, 2025