The Bank of Canada says it has growing concerns about the ability of households to service their debt, particularly with mortgage holders facing payment increases of up to 40% at renewal.

“In light of higher borrowing costs, the Bank of Canada is more concerned than it was last year about the ability of households to service their debt,” reads the Bank’s 2023 Financial System Review. “More households are expected to face financial pressure in the coming years as their mortgages are renewed.”

Compounding the issue is the fact house prices have come down from last year’s highs, reducing the amount of equity some owners have.

“…some signs of financial stress—particularly among recent homebuyers—are beginning to appear,” the Bank noted.

20% to 40% payment increase expected at renewals

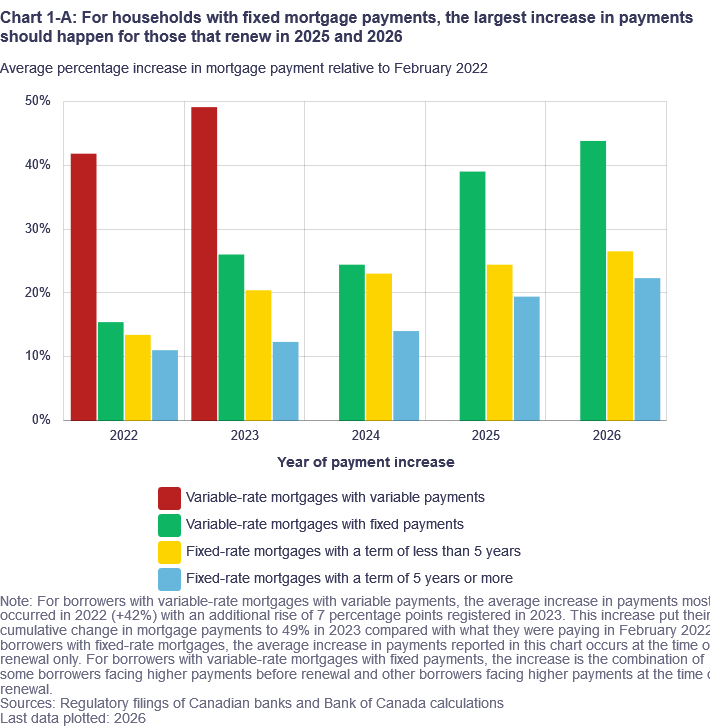

The Bank says about one third of mortgages have already seen increases in payments compared to February 2022, prior to the Bank’s latest rate-hike cycle.

However, by the end of 2026 it says all mortgage holders will have experienced a payment increase. The size of the increase will depend on their mortgage type and the previous rate they had obtained.

- Fixed-rate mortgages

Most fixed-rate mortgages will face renewal in 2025-26, with payment increases expected to be 20% to 25%, the Bank said.

- Variable-rate mortgages

All adjustable-rate borrowers (those whose payments vary as interest rates change) have already experienced payment increases, with some seeing their payments surge by more than 50%. Variable-rate mortgage borrowers with static monthly payments, where the amount of the payment going towards interest rises as interest rates increase, will need to increase their payments an average of 40% to maintain their original amortization schedule. This assumes a renewal in 2025 or 2026.

Debt-service ratios on the rise

The FSR also noted that rising interest rates have increased debt-servicing costs for many mortgage-holders, some of whom have seen their ratios increase significantly.

The Bank says the median debt-service ratio (DSR) on new mortgages rose from 16% to more than 19% in 2022. Meanwhile, the share of new mortgages with a DSR greater than 25% jumped to 29% from 12% over the same period.

“Higher DSRs reduce flexibility for borrowers who experience unforeseen increases in expenses or losses in income,” the report reads.

Increases should be “manageable”

The Bank says that while the increase in mortgage payments should be manageable for most households, “the impact will be more significant for some.”

Many will also have a “buffer” to support higher payments thanks to being stress-tested at higher rates when their mortgage was originated.

“In addition, the federal government has proposed a guideline to ensure that…financial institutions explore mortgage relief options to help Canadians manage the increase in mortgage rates,” the Bank adds.

Also benefiting households is the fact many will have experienced some income growth between the time their mortgage was originated and their term renewal.

“For some households, however, the combination of higher DSRs, lower home equity and longer amortization periods will reduce household flexibility in the event of added financial stress, such as reduced income,” the Bank noted.

Bank of Canada bank of canada interest rate BoC financial system review financial system review FSR mortgage payment increases mortgage renewals payment increases renewals rising rates at renewal time

Last modified: June 22, 2023

Any “concern” they have for homeowners is the BoC equivalent of Bill Cosby bringing a cup of coffee in the morning.

Edward HC Graydon

April 25, 2021 at 7:04 AM

Yesterday a house in Hamilton Ontario went up for sale in Westdale close to my children’s school {639,000} I will tell you I offered $674,000 and a immediate closing if they so desired with no stipulations or conditions I also gave a deposit of $65.000 on the house and they asked for $35,000. Yesterday being Saturday the offers where being accepted and I lost out on the house I think as I was told offers for over $700,000 was offered but at that immediate time the offer that was given did not immediately have with it a good faith deposit. My point is that in order to purchase a house or qualify for a mortgage of $500,000 you need an income of close to $200,000 a year . I think that because during covid jobs and income are not consistent and precarious at best the youth of today will be indebted for years to come all while having little job opportunities in the coming years .

I think if you add up the issues of precarious employment that presents its self to almost all regions of Canada while taking into account the governments announcement that it intends to raise rates soon, I believe real estate or the debt that is being held by those with large mortgages are going to take a wicked hit. Cash is still King in many ways.

Local Hamilton news headline as of Wensday June 12 2024.

Ontarian’s are under extreme financial strain as more mortgages come up for renewal at higher interest rates while unemployment creeps up, according to a new report by credit reporting agency Equifax.

In Ontario, the total mortgage balance reaching “severe delinquency” — 90 days or more without payment — exceeded $1 billion for the first time in the first quarter of 2024. That’s double the level recorded before the pandemic, the report stated.

“A shocking number,” said Rebecca Oakes, vice-president of advanced analytics at Equifax Canada. “And it’s not a case of it’s increasing or flattening — it’s still on an upward trajectory in terms of missed payments. That really is where the concern is coming from.”

The trend reveals that consumers, particularly those in highly priced housing markets, are still dealing with the crushing effects of inflation and higher-for-longer interest rates.

Of all mortgages renewing in the first quarter, around nine per cent saw monthly payments soar by more than $500. And it’s affecting everyone, not just mortgage holders.

Ouch !

I don’t have the words describe the underlying fear of unsettling anxiety I have from the current banking news regarding Canadian bank accounts ! It is so Dangerous somewhat like Russian roulette , as it truly is a gamble .

In Todays Globe and Mail an article was written stating how many Canadians are having their bank accounts closed . It is a horrible position to be in and almost impossible to deal with unless one declares bankruptcy .

Once a Canadian bank closes your account while being overextended it is really not possible to carry on a life as the relationship between you { the client who finds themselves closed} and the bank . It will become really very difficult to deal with . It is a terrible position to be in and it will cause a great deal of angst for those that have pledged their assets as collateral .

Today is February 1, 2025. And the article from Todays Globe and Mail sheds light on the dangers of banking in 2025 and the danger of over extenuation . I suppose the greatest gift one can have in 2025 is actual access to the system that facilitates materialism, the banking system in Canada . The issue is serious in that it effects all Canadians .

Personally I think HELOC loans and those Canadians that have that type of loan with the banks are going to be the biggest threat to the Canadian economy as the banks hold the right to offset .And when I combine this with the fact that the banks in Canada according to the Globe and Mail are closing accounts at record pace while acknowledging that today Canada will moving forward be losing jobs due to tariffs from the United States and accepting the general undertone of the current American administration,

I think the gluttony of human greed and ambition when entering the real estate market based on false financial records and those that might have fallen victim to temptation to manipulate ones true financial statues might have a great deal to worry about.