CMHC recently surveyed 2,507 new mortgage consumers. Here’s what they found:

CMHC recently surveyed 2,507 new mortgage consumers. Here’s what they found:

- 70%: Feel now is a good time to buy a home in Canada

- 1/3: Expect to move in the next five years

- 73%: Used their own resources (savings, equity, or RRSP) for their down payment.

- 1/3: Have previously requested their credit score from a credit bureau. (Wow. 2/3 have not?)

- 87%: Believe that 40% is the maximum ratio of monthly gross income that one should spend on debts and housing (It’s interesting that so many people know this. This 40% figure is, of course, a general lender guideline for maximum TDS.)

What matters to homeowners:

- “Getting the best rate”: This was the number one thing that made customers satisfied with their lender or broker.

- “Service”: The top reason driving customer satisfaction with brokers.

- “A good relationship”: The top reason behind customer satisfaction with lenders.

Other interesting market share stats:

- 90%: The number of people up for renewal who stayed with their existing lender. That compares to 83% in 2007. (This is absolutely stunning. Either lender retention departments are getting much better or people are getting more complacent. In this competitive market, you’ve got to shop around—or, better yet, get a professional to do it for you.)

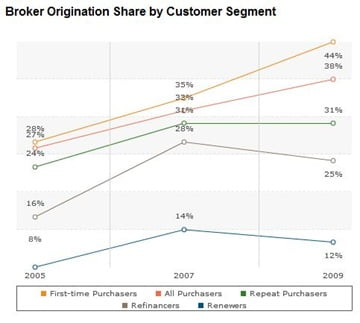

- 25%: The number of mortgages originated by mortgage brokers. CMHC said it was 27% in 2007 (See CMHC’s 2007 Mortgage Survey). (The banks seem to be making a comeback for the time being. They’re most definitely getting more competitive. In addition, we’re seeing a lot of smaller lenders harness the power of the net to drive new business.)

- 44%: The number of first-time buyers who got their mortgage through a broker. (This is up sharply from 35% in 2007.)

Click to enlarge.

Source: The chart and all data are courtesy of CMHC. For a summary of CMHC’s complete findings, click here.

Last modified: April 28, 2014

In case anyone’s curious, here’s the main reasons people said they renewed with their existing lender…

45% said: Rate/deal reasons (i.e., terms/conditions, product specific reasons)

33% said: Service

20% said: Convenience

Bet ya that last 20% figure is much higher in reality….

Greetings

Do you have a breakdown by province in effect Quebec

Very interesting findings. What is not mentioned here, is that a lot of people are “checking out the rates” with the mortgage brokers/agents first, then they go to the bank to beat the best offer for which the broker/agent spent a lot of time preparing it.

This is that”great service” offered by the banks at renewal time.

Adrian it is often the opposite.

I’d estimate that 3/4 of my new customers come to me (I’m a broker) after getting a quote from their bank.

I’m not surprised at all that 2/3 people haven’t requested their credit score. It’s often over looked, which is unusual ’cause that’s one of the first things any creditor will look at when deciding how much (or little) money to lend.